Do you have a problem with filing GST Returns? (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) Best GST Filing Centre in Tamilnadu Get Expert Assisted Services at an affordable price Trusted by 55,000+ Happy Businesses The taxpayer must approach...

How to Register Unregistered Transporters on www.ewaybill.nic.in

The transporter should generate an e-Way bill if,

a. When the value of the goods of a single supplier exceeds 50,000 INR

or

b. When the value of all the goods in the vehicle exceeds 50,000 INR

TRANSPORTER ID FOR UNREGISTERED TRANSPORTERS

When a transporter is unregistered and if the goods in the vehicle exceed 50,000 INR, then the transporter should generate an e-Way bill. In order to avoid confusions, the concept of Transporter ID is introduced. Every unregistered transporter will be provided with a Transporter ID, which they should mention instead of the GSTIN.

By registering on the e-Way Bill portal, the outcome will be

- The Transporter gets a unique Transporter ID

- A Unique username to work on the e-Way portal

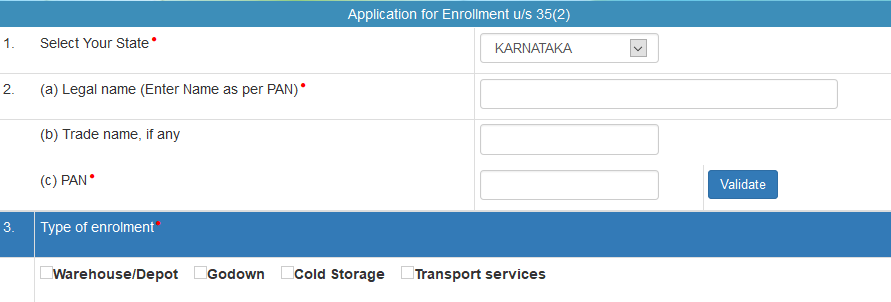

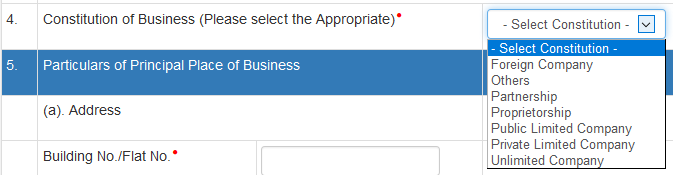

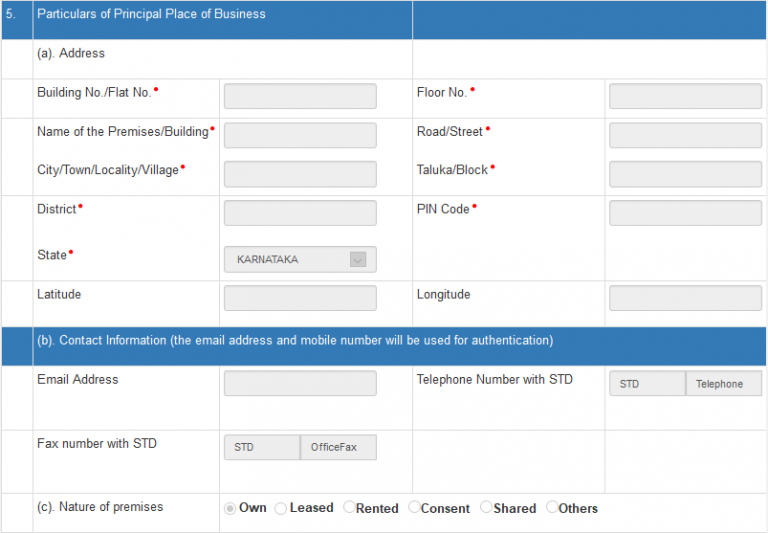

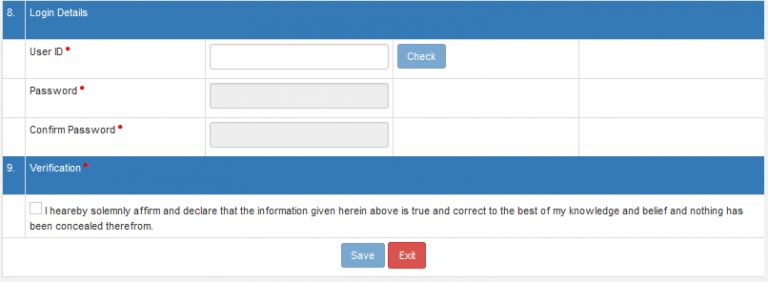

Here step by step guide for unregistered transporter to get the transporter id on EWB Portal

Step 2: Select “Enrollment for Transporter” links under the Registration and click on the link.

| Read Also : Guide to Generate e-Way Bills on e-Way Bill Portal

HOW TO REGISTER ON E-WAY BILL PORTAL? – UNREGISTERED SUPPLIER

If the goods are received from the unregistered suppliers, then the receivers should comply with all the procedures of generating the e-way bill by considering himself as the supplier. The receiver will be one who should generate the e-way bill in case if he is buying the goods from an unregistered supplier.

Thanks for reading this Article. Please comment below for any queries!

Do you have a problem with filing GST Returns?![]() (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2)

(GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) ![]()

Best GST Filing Centre in Tamilnadu

Leave your GST filing worries to our Expert

Trusted by 55,000+ Happy Businesses