Simplified GST Return Formats – Form Sahaj and Sugam, July 2018

“In month one and two of the quarter, such taxpayer shall report NIL transaction by sending an SMS. Facility for filing a quarterly return shall also be available by an SMS,” the Central Board of Indirect Taxes and Customs (CBIC) said while unveiling the draft returns forms.

New Update:

Proposed GST Return Formates, as approved by the competent authority on 8th March 2019, you can now be downloaded from the Download section of the GST Portal (www.gst.gov.in).

Small taxpayers would be those who have a turnover up to Rs 5 crore in the last financial year and can file a quarterly return with monthly payment of taxes on a self-declaration basis.

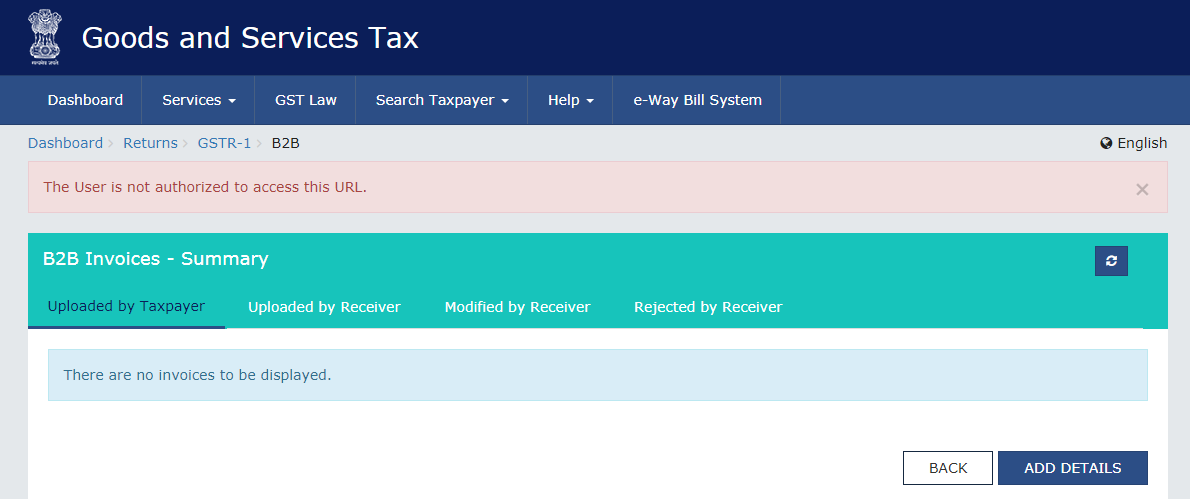

The return form ‘Sahaj’ is for businesses which make supplies to only consumers (B2C). It includes details of outward supplies and inward supplies attracting reverse charge as well as a summary of inward supplies for claiming input tax credit (ITC). Also, such B2C businesses will have to show HSN wise summary of supplies and interest and late fee liability details along with payment of tax and verification.

Besides, businesses making supplies to both businesses (B2B) and consumers (B2C) have to file returns form ‘Sugam’. It includes a summary of supplies made and tax liability, a summary of inward supplies for claiming ITC, along with details of interest due and tax payment.

Such businesses will have to file annexure to the return form giving details of outward supplies made to registered persons, consumers and un-registered persons (B2C and B2B) and inwards supply attracting a reverse charge. Also HSN wise summary of supplies

The forms, which will replace the current GSTR-3B and GSTR-1, are expected to be launched by 1 January 2019.

Thank you for reading

Do you have a problem with filing GST Returns?![]() 😀 (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) Feel free to Call us on 7339666455. SAVE MY TAX –

😀 (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) Feel free to Call us on 7339666455. SAVE MY TAX – ![]() 💓 GST FILING CENTRE.

💓 GST FILING CENTRE. ![]() Tirupur.

Tirupur.

Best GST Filing Centre in Tamilnadu

Get Expert Assisted Services

Trusted by 55,000+ Happy Businesses