GST Return Preparation & Filing in India

Leave your GST filing worries to our experts Request A Callback

Type of Plastics Ban in Tamil nadu

The Tamil Nadu government announced on Tuesday 5th June 2018 it would ban the use of plastic items, including non-biodegradable carry bags, from January 2019 to "gift a plastic-free" state to future generations. As per G.O. (Ms) No.84 The Tamil Nadu Govt have decided...

The User is not authorized to access this URL under GST Portal

If you are getting "The User is not authorized to access this URL." Error at the time of Submitting GSTR-1. Please wait up to 3 minutes on the same page and Try to submit one more time. After that, you get this message "Your Submit request has been received, please...

Filing Process of Annual Return under GST (GSTR-9, 9A, & 9C)

Law Provisions (ACT) 35(5) - Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts,...

Annual Return under GST – GSTR 9, GSTR 9A, GSTR 9B, GSTR 9C.

Annual return (GSTR 9) to be filed once in a year by all registered taxpayers under GST including who is registered under composition levy scheme. It consists of details regarding the supplies (sales) made and received during the year under different tax heads i.e....

Extension of due dates for Filing GST Returns

The Ministry of Finance on Wednesday extended the due dates for filing of Goods and Services Tax (GST) returns for taxpayers in Srikakulam, Andhra Pradesh affected by Cyclone Title and 11 districts of Tamil Nadu affected by Cyclone Gaza. The 11 affected districts in...

Guide to Change Mobile Number and Email ID in GSTN Portal

Most important for every dealer must entered Mobile number and email id in GST Common portal. Many registered dealer want to know how to change mobile number and email id in GST Common portal. Guide to update Mobile number and e-mail ID in GST Common portal 1. Login...

PM launches historic Support and Outreach Initiative for MSME Sector

The Prime Minister, Shri Narendra Modi, today launched a historic support and outreach programme for the Micro, Small and Medium Enterprises (MSME) sector. As part of this programme, the Prime Minister unveiled 12 key initiatives which will help the growth, expansion...

Guide to Generate GSTR2 Summary

Generate GSTR-2 Summary Scroll down to the bottom of the GSTR-2 – Inward Supplies received by the Taxpayer page and click the GENERATE GSTR-2 SUMMARY button. This action will update the summary on the tiles and you will be able to view the number of auto-drafted...

Enhancements in E-Way Bill System www.ewaybillgst.gov.in

The Proposed improvements in e-way bill generation,being released on 16.11.20181. Checking of duplicate generation of e-way bills based on same invoice numberThe e-way bill system is enabled not to allow the consignor/supplier to generate the duplicate e-way bills...

Faqs on GST E-way Bill

The e-Way Bill is a document to be carried by the person in charge of the transportation of goods exceeding 50,000 in value. e-Way Bill gives you a direct correlation between what is reported and what actually moved Any person registered on GST or the e-Way Bill...

GST Services in Madurai Contact Number – 7339666455

What is GST Seva Kendra? The one-stop GST facilitation center, GST Seva Kendra was launched by the CBEC in February 2017, to cater to the taxpayers and businesses then preparing for the GST registration. The breakthrough initiative was taken up to help them become...

Selling of Space for Advertisement in print media under GST

Selling of Space for advertisement in print media I.GST applicable on selling of space for advertisement in print media ? 1.Selling of space for advertisement in print media is leviable to GST @ 5%. If the advertisement agency works on principal to principal basis,...

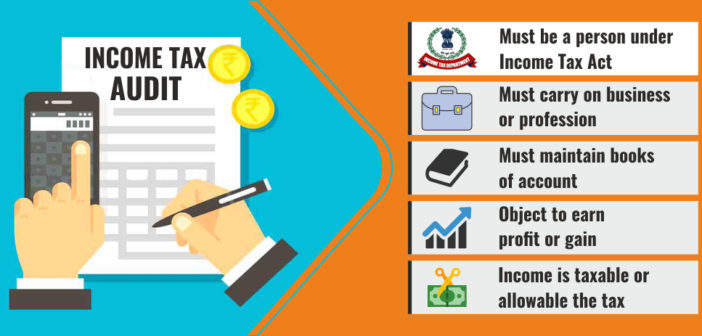

Requirement for Filing Tax Audit Report as per Income Tax Act

As per the section 44AB of Income Tax Act, the books of accounts for the relevant previous year are required to be audited by a Chartered Accountant and the audit report has to be electronically filed prior to or along with the return of income before the due date. In...

GST Seva Kendra in Tamilnadu Contact Number, 7339666455

Do you have a problem with filing GST Returns? (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) Best GST Filing Centre in Tamilnadu Get Expert Assisted Services at an affordable price Trusted by 55,000+ Happy Businesses The taxpayer must approach...