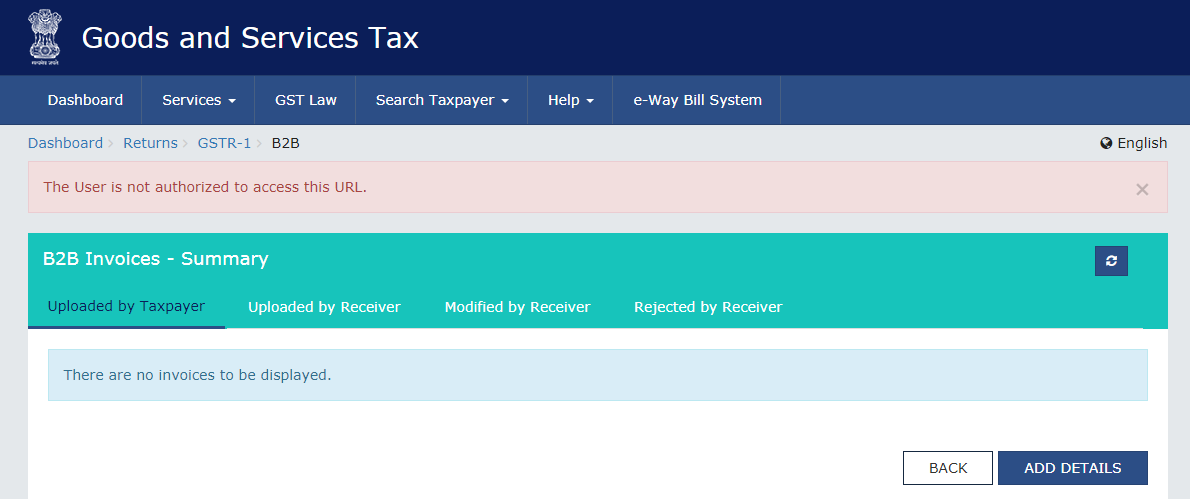

The User is not authorized to access this URL under GST Portal

Update on 21.01.2019

If you are getting “The User is not authorized to access this URL.” Error at the time of Submitting GSTR-1. Please wait up to 3 minutes on the same page and Try to submit one more time. After that, you get this message “Your Submit request has been received, please check the status in

Admin www.savemygst.in

While filing your GSTR1 NIL Return or Adding Invoices you getting an error “The User is not authorized to access this URL.”

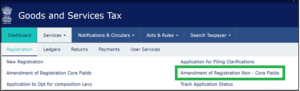

If this error is stopping you from filing your GSTR-1 then You can check the status of your GSTIN in the GST portal

“Search taxpayer >> Search by GSTIN >>Provide your GSTIN.

If it says cancel then you need to visit your company Jurisdictional Office. (Your Circle Commercial Tax Government office)

or

Please check View Notices and orders under user services, if registration cancelled. the error become like this.

Reason for Cancellation:-

- A taxpayer other than composition taxpayer has not filed the monthly returns for a continuous period of six months

- Supplies any goods and / or services without issue of any invoice, in violation of the provisions of the Act or rules made there under, with the intention to evade tax

- Issues any invoice or bill without supply of goods and/or services in violation of the provisions of this Act, or the rules made there under leading to wrongful availment or utilization of Input Tax Credit or refund of tax

- Collects any amount as representing the tax but fails to pay the same to the account of the Central/State Government beyond a period of three months from the date on which such payment becomes due

- Fails to pay any amount of tax, interest or penalty to the account of the Central/State Government beyond a period of three months from the date on which such payment becomes due

- A person is no longer liable to deduct tax at source as per the provisions of GST Law

- A person is no longer liable to collect tax at source as per the provisions of GST Law

- Person no longer required to be registered under provisions of GST Law

- GST Practitioner is found guilty of misconduct in connection with any proceeding under the GST Law.

- Discontinuation/Closure of Business

- Change in Constitution leading to change in PAN

- Ceased to be liable to pay tax

- Transfer of business on account of amalgamation, merger/demerger, sale, lease or otherwise disposed of etc.

- Death of Sole Proprietor

- Composition person has not furnished returns for three consecutive tax periods,

- Registration has been obtained by means of fraud, willful misstatement or suppression of facts. Etc.

If it says active and you are getting this error message its still better to visit the Jurisdictional Office and check the reason for revoking your GSTIN access.

Or

If the other possibilities are ruled out then it is purely GST Server error, just changing the browser will help you. or Try later

|Read Also: Annual Return under GST – GSTR 9, GSTR 9A, GSTR 9B, GSTR 9C.

Do you have a problem with filing GST Returns?![]() (GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2)

(GSTR-1, GSTR-3B & Matching Purchase Register with GSTR-2) ![]()

Best GST Filing Centre in Tamilnadu

Get Expert Assisted Services

Trusted by 55,000+ Happy Businesses