How to File Annual Return GSTR-9 for Fy 2017-18

The much-awaited GSTR – 9 i.e. Annual Return* for FY 2017-18 is now enabled for filing at the GST Portal (WWW.GST.GOV.IN)

ITC figures are getting auto-populated. Also, a summary of GSTR-1 and GSTR-3B is allowed to be downloaded in PDF format.

Also, “NIL” GSTR-9 RETURN can be filed, if you have

- Not made any outward supply (commonly known as a sale); AND

- Not received any inward supplies (commonly known as purchase) of goods/services; AND

- No liability of any kind; AND

- Not claiming any Credit during the Financial Year; AND

- Not received any order creating demand; AND

- Not claimed any refund.

during the Financial Year

|Read Also: Filing Process of Annual Return under GST (GSTR-9, 9A, & 9C)

2.GSTR-9 can be filed online. It can also be prepared on Offline Tool and then uploaded on the Portal and filed.

3.Annual return in form GSTR-9 is required to be filed by every taxpayer registered as normal taxpayer during the relevant financial year.

4.All applicable statements in Forms GSTR-1 and returns in Form GSTR 3B of the financial year shall have been filed before filing GSTR-9.

Important Note:-

- Annual return in Form GSTR-9 once filed cannot be revised.

- Computation of ITC based on GSTR-2A has been auto-populated by the System based on GSTR-1 filed by your corresponding suppliers up to 28-02-2019 . Next auto-updating of GSTR-2A will be carried on 31-03-2019. If you have some missing credits in GSTR-2A, you may like to wait till next update.

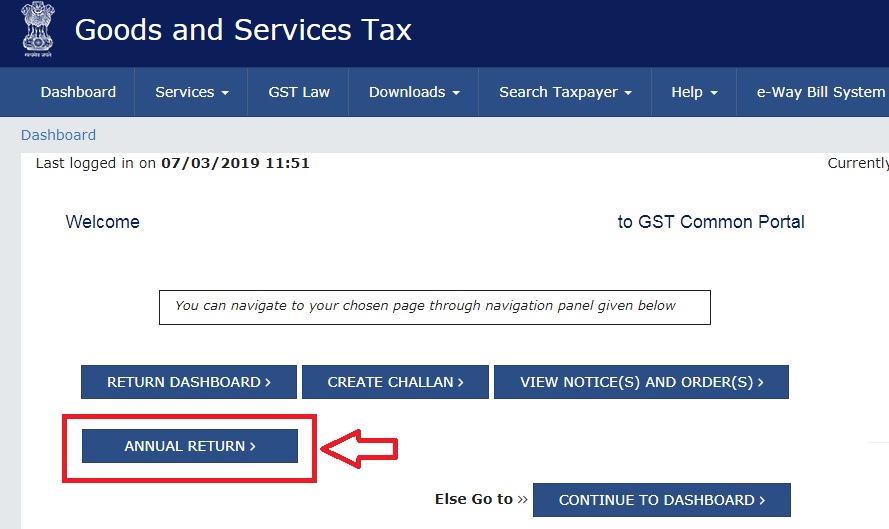

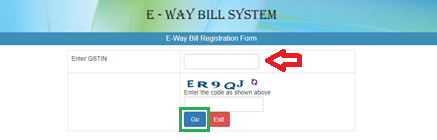

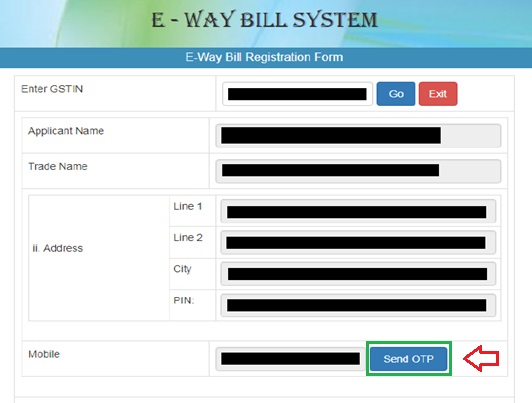

How to Prepare Online:-

Steps to be taken:

- Click on ‘Prepare Online’;

- Select from the questionnaire page, whether you wish to file NIL Annual return;

- You may download the draft system generated GSTR-9, a summary of GSTR-1 and summary of GSTR-3B from GSTR-9 dashboard for your reference;

- If the number of records/lines is less than or equal to 500 records per table (Table 17 and Table 18), then you may use this facility;

- Fill in the details in different tables and click on ‘Compute Liabilities’; and

- Click on ‘Proceed to file’ and ‘File GSTR-9’ with DSC/EVC.

- Additional liability, if any declared in this return can be paid through Form GST DRC-03 by selecting ‘Annual Return’ from the dropdown in the said form. Such liability can be paid only through cash.

Prepare Offline:-

If the number of records/lines either in Table-17 or Table-18 are more than 500 records per table, then you can prepare your return by using the offline utility only and the same can be subsequently uploaded on Common Portal.

You can download the GSTR-9 offline tool from the ‘Downloads’ section in the pre-login page on the portal and installed it on your computer.

- Click on ‘Prepare Offline’;

- Click on ‘Download’ to download auto-drafted GSTR-9 details, if any;

- Follow instructions in ‘GSTR-9 offline tool’ to add details and generate JSON file for upload; and

- Click on ‘Upload’ to upload JSON file and file the return with help of instruction available on GSTR-9 dashboard.

File GSTR-9 with SAVE MY GST

Get Expert Assisted Services at an affordable price

Trusted by 55,000+ Happy Businesses