Stakeholder Consultation on Proposed Changes to GST Laws in india

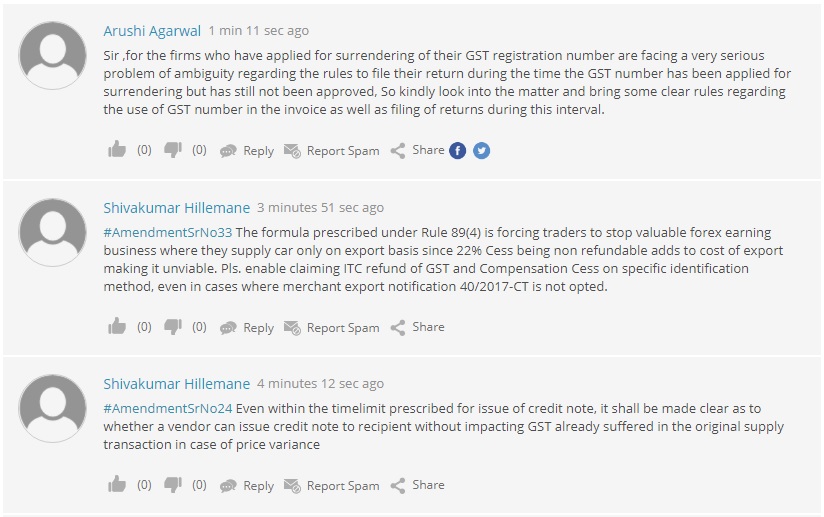

Stakeholder Consultation on Proposed Changes to GST Laws: In order to attract a large volume of stakeholders and the general public. The department of revenue had opted for public and stakeholder to make their valuable comments/feedback on the draft proposals for amendments of CGST Act 2017, IGST Act 2017 and the GST (Compensation to States) Act 2017 in the public domain through this discussion on MyGov.in.

Added to it comments/feedback using hashtag #AmendmentSrNo1 for comments pertaining to amendment detailed at serial no.1 of the draft proposals and followed by #AmendmentSrNo2 for comments pertaining to amendment detailed at serial no. 2 of the draft proposals.

In case you have more than one suggestion/feedback to offer, you may find it convenient to type out your comments in a separate document, with hashtags specifying the Serial No. for which the comments are being given.

Last date of submission is 15th July 2018

Best GST Filing Centre in Tamilnadu

Expert Assisted GST Compliance Services

Trusted by 55,000+ Happy Businesses