GST Return Preparation & Filing in India

Leave your GST filing worries to our experts Request A Callback

GST Seva Kendra | GST Office chennai contact details

GST Registration @ Rs.1000/- only GST Return filing starts from Rs.300/- onwards Trusted by 55,000+ Happy Businesses The taxpayer must approach the relevant GST Seva Kendra Centre based on range and division. The list below shows All GST Seva Kendra Chennai...

Govt waives off late fee on GSTR-1 & GSTR-3B in certain cases

It has been observed that the number of taxpayers who have filed FORM GSTR-3B is substantially higher than the number of taxpayers who have furnished FORM GSTR-1. Non-furnishing of FORM GSTR-1 is liable to late fee and penalty as per the provisions of the GST law. In...

How to File Form GST RFD 11 – Letter of Undertaking under GST

‘Export’ and ‘Supply to SEZ units’ collectively termed as “Zero-rated Supply” under GST. Therefore the Procedures for ‘Export’ and ‘Supply to SEZ without charging tax’ are similar ( Form GST RFD 11 ) A registered person making zero-rated supply shall be eligible to...

E-way Bill under GST – Rules to Generate E-way Bill

Rules to Generate Eway Bill:- A waybill is a receipt or a document issued by a carrier giving details and instructions relating to the shipment of a consignment of goods and the details include name of consignor, consignee, the point of origin of the consignment, its...

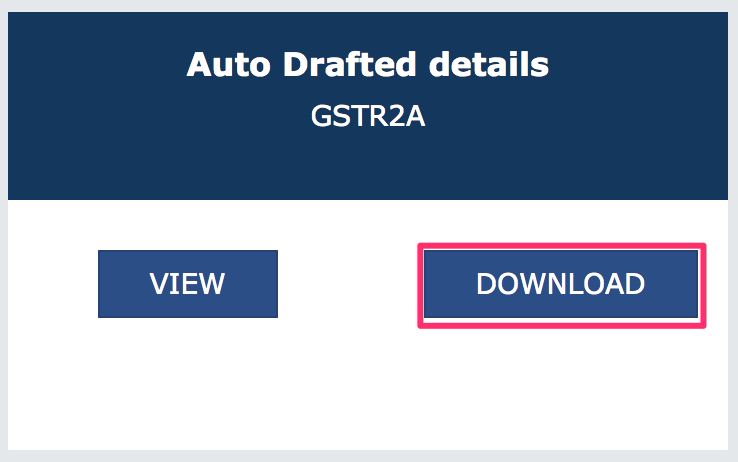

Guide to view the Inward Supplies Return GSTR-2A

Guide to view the Inward Supplies Return GSTR-2A? GSTR-2A will be generated in below scenarios, • When the supplier uploads the B2B transaction details in GSTR-1& 5/ & • ISD details will be auto-populated on submission of GSTR-6 by the counterparty / & •...

GST eway Bill in Tamil Nadu

மின் வழிச் சீட்டு ( GST eWay Bill ) என்பது சரக்குகளை கொண்டு செல்வதற்காக பொது வலைத்தளத்தில் உருவாக்க வேண்டிய ஒரு ஆவணமாகும். மின் வழிச் சீட்டின் முக்கிய கூறுகள். உருவாக்க மிகவும் எளிதானது. எளிதாக சரிபார்த்துக் கொள்ளலாம். வணிகம் தொடர்பான அறிக்கைகளை உருவாக்கிக்...

How to file GSTR-2 Inward Supplies

What is GSTR-2? GSTR-2 is a return form which should be submitted for “Return for Inward supplies for a tax period” by each registered person, in India, during a calendar month. GSTR 2 Return form contains 13 points in which the following details need to be captured:...

Applicability of Section 234F of Income Tax Act w.e.f. 1st April 2018

Insertion of new section 234F:- 76. After section 234E of the Income-tax Act, the following section shall be inserted with effect from the 1st day of April, 2018, namely:— "234F. Fees for default in furnishing return of income.—(1) Without prejudice to the provisions...

Major Changes in Income Tax Law w.e.f 1st April, 2018

Photo credit:newsworldindia.in Income Tax Exemption limit is Rs.2,50,000/- After that, up to 5 Lakh, Tax rate is 5% (earlier it was 10%) Payment of Rent - Rs.50,000 per month by any Individual or HUF (not subject to Tax Audit requirement) - Deduct TDS @5%. Cess...

List of Goods Exempted from an Eway Bill Generation

GST e-Way bill must be generated for any transport of goods within India wherein the value of the consignment is over Rs.50,000. When an E-way Bill Generation is required ? Every registered person who causes movement of goods of consignment value exceeding Rs.50000/-...

New GST Registration Process

What Is the Necessary For New GST Registration? New GST Registration is needed for all the suppliers who run their business across India. GST Registration must be for all the companies, small startups, industries who make a profit over the prescribed turnover limit in...

Composition Scheme Applicable GST Rate

1. What is Composition Scheme under GST ? The composition scheme is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs.1.5 crore* ( Rs. 75 lakhs* in case of few States). The objective of composition scheme is to bring...

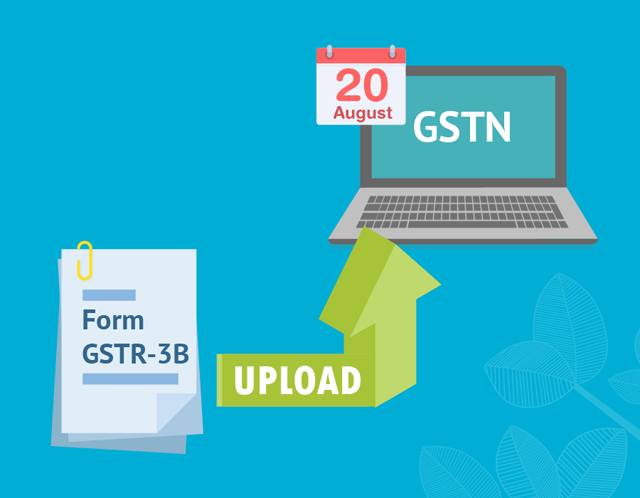

GSTR 3B Revised – New Features Introduced by GST Council

GSTR 3B is a simplified summary return and the purpose of the return is for taxpayers to declare their summary of GST liabilities for the tax period and the discharge of these liabilities in a timely manner so as to ensure the Central and State Governments receive...

HSN summary of inward supplies

1. To give points of interest of HSN summary of inward supplies / Purchase, click the 13 - HSN summary of inward supplies tile. 2. The 13 - HSN summary of inward supplies page is displayed. Click the ADD DETAILS button to include the information. 3. In...