The online E Waybill should be generated not only for the transportation of goods but also for purchase from an unregistered person, inter-branch transfer, sales return and transfer because of job work.

The online E Waybill portal gives a consistent gateway to generate E-Way bills (single and same as consolidated options), Modify or update vehicle number on the already generated e-Way bill, cancel of E-Way bill, Rejection of E-Way Bill, etc.

There are two methods of generating the e-Way Bills in EWB-1

1. On the Web-based System

2. Via SMS – (Short message Service)

| Read Also : How to Generate Consolidated e-Way Bill on EWB Portal

Before generating the online e Way Bills on web you should make sure these points:

- Registeration on the online e Way Bill portal – www.ewaybillgst.Gov.in

- The Invoice / Bill / Challan of the particular consignment of goods must be in hand.

- If transport is by road – Transporter ID or the Vehicle number should be present.

- If transport is by rail, air, or ship – Transporter ID, Transport document number, and date must be mentioned in the document.

Here is step by step Guide to Generate Online e-Way Bill :

Go to www.ewaybillgst.gov.in

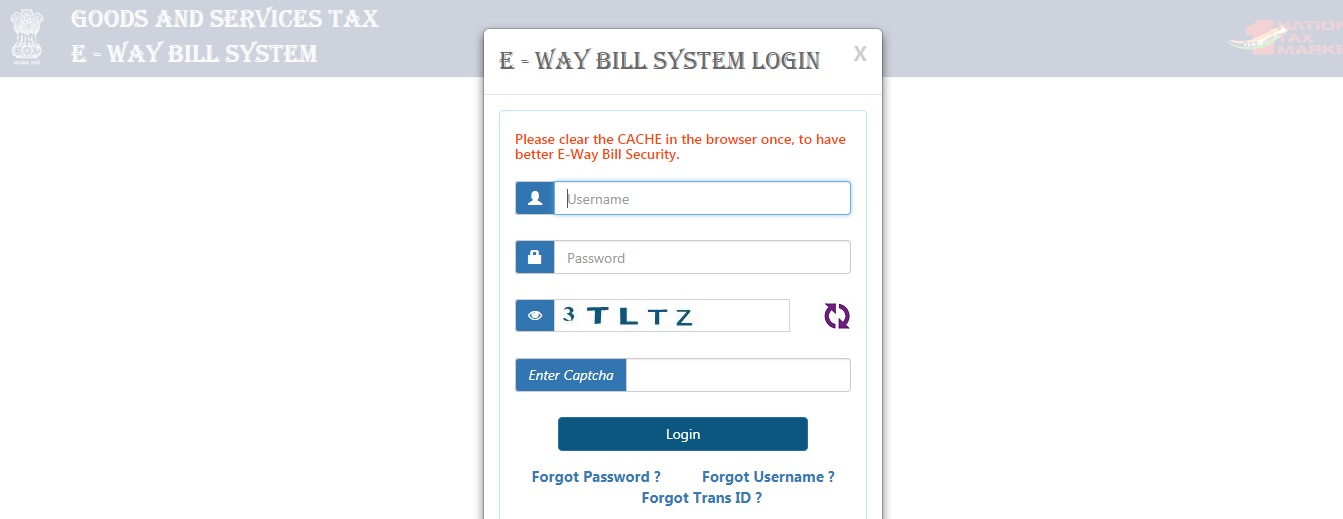

#STEP 1 : Login to the e-Way Bill Portal. Enter your Username, Password and Captcha code, click on login button

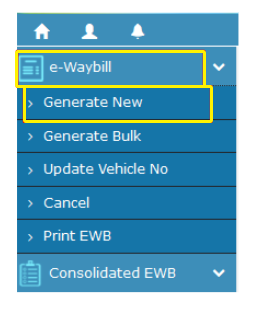

#STEP 2: Under the e-Way Bill option on the left-hand side of the dashboard > Select ‘Generate new’ from the drop-down list.

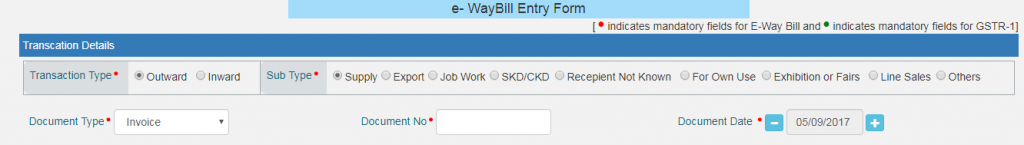

#STEP 3: Enter the following details on the screen that appears.

If you are a supplier of the particular consignment Select ‘Outward’

If you are a recipient of the particular consignment Select ‘Inward’

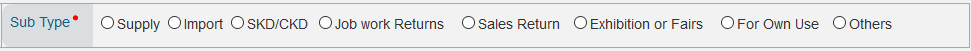

2. Sub-type:

Select the relevant sub-type applicable to you.

If transaction type selected is Outward, you will see the following subtypes:

Select either one from Invoice/ Bill/challan/credit note/Bill of entry or others if the documents you have is not Listed.

4. Document No. :

Enter the document / invoice number

5. Document Date:

Select the date of Invoice or challan or Document.

To be Noted: The system will not allow the user to enter a date ahead of the present date.

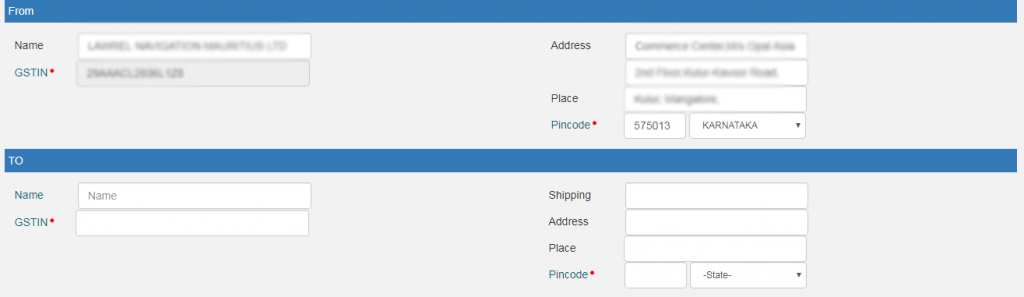

6. From / To:

Depending on whether you are a supplier or a recipient, enter the To / From section details.

7. Item Details:

Add the details of the consignment (HSN code-wise) in this section:

- Product name

- Description

- HSN Code

- Quantity,

- Unit,

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

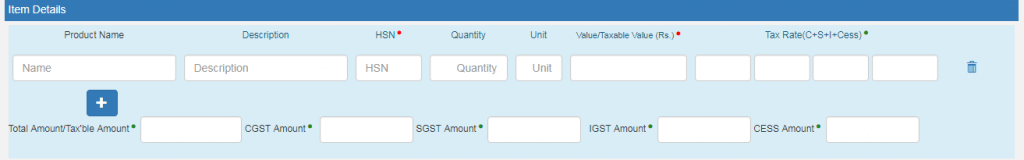

Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, Either of the details can be mentioned:

Transporter name, transporter ID, transporter Doc. No. & Date.

OR

Vehicle number in which consignment is being transported.

Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234

Otherwise, your request is processed and the e-way bill in Form EWB-01 form with a unique 12 digit number is generated.

The generated e-way bill looks like this:

GST Registration & Return filing Services in Tamilnadu

Leave your GST filing worries to our Expert

Trusted by 55,000+ Happy Businesses