File GSTR2 on GSTN portal

Every registered person is required to give details of Purchase, i.e., Inward supply of a tax period in GSTR2. Form GSTR2 contains details of all the purchase transactions of a registered dealer for a month.

STEPS TO FILE GSTR2

1. Log in to the GST portal with valid credentials (User Id, Password).

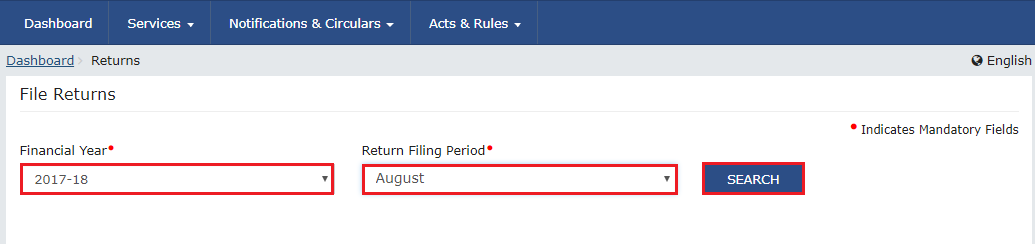

2. Navigate to the GSTR 2 home page through >Return Dashboard> Select Financial Year (2017-18) and Return Filing Period and click on Search button> Click on PREPARE ONLINE option on GSTR 2 tab.

3. You will find 12 tiles on GSTR 2 page for entering data for different sections of GSTR 2.

Click on ‘GENERATE GSTR 2 SUMMARY’ to ensure that auto-populated details become available in your GSTR 2.

4. Click on each tiles and enter the required details and save to prepare the return.

5. Accept, Modify, Reject and Keep Pending auto-populated invoices/credit/debit notes with ‘submitted’ status uploaded by the registered suppliers in their submitted GSTR 1 on the basis of records available with you and declare the Eligibility of ITC and ITC availed/reduced in section tile 3.4A or 6C.

6. One of the above four actions is mandatory on all auto-populated invoices with

‘submitted’ status available in your GSTR 2.

7. The GSTIN of the supplier, invoice number, invoice date, invoice type, reverse charge flag & POS cannot be modified. If one wants to change these fields one has to reject such auto-populated details and add them as missing invoice details.

8. Missing invoices/debit/credit notes details (not uploaded by suppliers but you have these documents) can be added through the ‘Add Missing Invoices’ tab in sections 3.4A or 6C. The invoices of same supplier with same number but different date cannot be added as missing invoice if these are available as auto-populated invoice with ‘submitted’ status in the recipients GSTR 2.

9. Invoice details which are saved by the supplier and not submitted are also available in GSTR 2 with ‘saved’ status. The details of such invoices can be added though missing invoice tab. This has been done to facilitate quick updation of invoices.

10. Furnish the invoice/credit debit note details of supplies of goods and services received from unregistered supplier and the Eligibility of credit and credit availed/reduced on them.

11. Furnish the invoice/credit debit note details of import of services and the Eligibility of credit and credit availed/reduced on them.

12. Provide the Bill of entry wise details of goods imported from outside of India or received from SEZ units and the Eligibility of credit and credit availed on them.

13. Provide summary details of

a. Advances received and liability on them

b. Adjustment of advance tax paid earlier for supplies made in the tax period

c. Consolidate values of inward supplies from composition taxpayers, nil rated, other

exempt and non GST

d. Reversals and Reclaim of ITC under different provisions of GST law.

e. HSN summary of inward supply

14. After providing the above details in applicable tiles click on ‘GENERATE GSTR 2 SUMMARY’ to update the tiles summary. Remember that initially the tile summary is zero even though there are auto-populated invoices available in your GSTR 2. The summary on the tiles is summary of invoices/debit/credit notes accepted/modified and added by you and other details. The System takes around 10 minutes to create a Generate GSTR 2 summary report.

15. GSTR 2 can be prepared online if the invoice numbers are few, around 100. If the autopopulated

invoices are large, it is advisable to use offline tool for preparing GSTR 2. The offline tool can be downloaded from https://www.gst.gov.in/download/returns.

16. After you have prepared GSTR 2 using Offline Tool, generate JSON file using offline tool. The key steps for preparing GSTR 2 through offline tool are as follows

a. Download the version 2.0 of Return Offline tool.

b. Extract and Install it on your Computer. An icon will be created on the Desktop of your computer

c. Download the auto-populated file of GSTR 2 by clicking on prepare offline tab on GSTR 2 tiles on Return home page and generating the download file by clicking on “Download data for GSTR 2” and clicking on the file/s generated after some time.

d. Open the downloaded file in the offline tool and prepare your GSTR 2 by taking action on the auto-populated invoices with submitted status and furnishing other required details. A JSON file can be generated by clicking on Generate JSON tab.

e. Log in the portal and upload the generated JSON file.

f. The downloaded file opened in the offline tool can also be exported as an excel file and the actions of Accept/Reject/Modify/Keep Pending can be stated in the action taken column of the excel file and other details furnished in the different worksheets to prepare the excel file of GSTR 2. This excel file can then be imported in the offline tool and a JSON file prepared which can then be uploaded to the portal to

prepare your GSTR 2.

17. Click on ‘preview’ and download the draft preview report as pdf document and verify the entered data with your accounting records. In case of any discrepancy correct the furnished data.

18. Ensure, there is no error in the furnished data. Remember, once you submit your GSTR 2, you cannot make any changes in the GSTR 2. Any changes can then be made only in next tax period GSTR 2 through amendment tables.

19. Click on Submit button to submit the GSTR 2.

20. Click on File Return button, and file the return with applicable mode of electronic

signature (DSC/EVC) after selecting the authorized signatory.

Easy to file All your GST Returns

Get Free Support & Training

How to create submit and file Form GSTR2

Step by Step Guide to create, submit and file details for the inward supplies in the Form GSTR-2 ?

1. Login and Navigate to GSTR-2 page

1. Access the www.gst.gov.in website. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials. ( Username & Password)

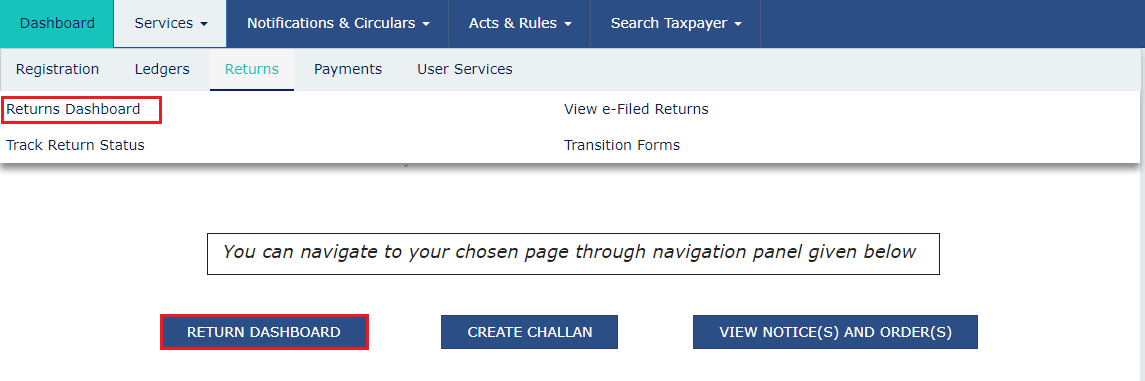

3. Click the Services > Returns > Returns Dashboard command. Alternatively, you can also click the Returns Dashboard link on the Dashboard.

4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

5. Click the SEARCH button.

6. The File Returns page is displayed. This page displays the various GSTR along with the due date of filing the returns, which the taxpayer is required to file as separate tiles. In the GSTR-2 tile, click the PREPARE ONLINE button if you want to prepare the return by making entries on the GST Portal.

Note:

- The due date for filing GSTR-2 is 15th of the succeeding month.

- You cannot file GSTR-2 return from 1st -10th of any month.

- You can click the PREPARE OFFLINE button to upload the JSON (Java Script Object Notation) file containing invoice details and other GSTR-2 details in the GSTN specified format prepared through the GSTN provided offline tools or SAVEMYGST software.

Easy to file All your GST Returns

Get Free Support & Training