GST Return Preparation & Filing in India

Leave your GST filing worries to our experts Request A Callback

Documents Required to Get FSSAI (Food Safety) Registration

Documents Required to obtaining FSSAI (Food Safety and Standards Authority of India) Registration Certificate:- Form B – signed Photo of FBO (Food Business Operators) Document for Identity Proof like Ration Card, Voter ID Card, PAN Card, Driving License, Passport,...

FSSAI in Tamil – Registration or License

FSSAI உணவுப் பாதுகாப்பு மற்றும் தரப்படுத்தல் ஆணையம் (Food Safety and Standards Authority of India) என்பது இந்தியாவின் உணவு பாதுகாப்பு மற்றும் தர நிர்ணய ஆணையத்திடம் உள்ளது, இது இந்தியாவில் உள்ள உணவு வணிகத்தை கண்காணித்து நிர்வகிக்கிறது. உணவு பொருட்கள் தரமான...

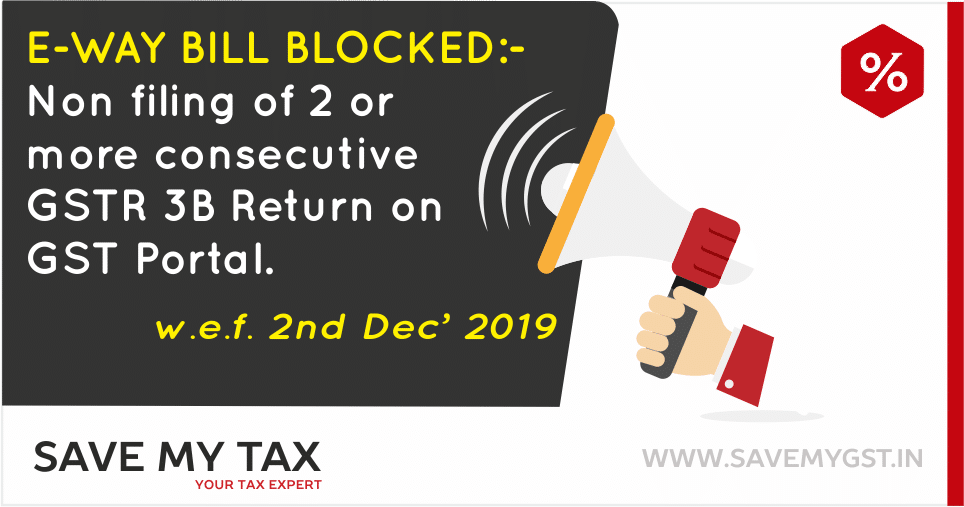

Eway Bill Generation Blocking – Non filing of GSTR-3B Return

Blocking of EWB generation facility: Blocking/unblocking of EWB generation facility has been implemented on EWB Portal from 2nd December, 2019. Meaning of blocking: The blocking of E Way Bill generation facility means disabling taxpayer from generating E Way Bill...

New TDS Rule on Cash Withdrawal from Bank – 1st September 2019

New TDS Rule on Cash withdrawals as per amendment in the Income-tax Act A TDS of 2% on Cash Withdrawal will be applicable if • Total cash withdrawal across all bank accounts under your PAN exceeds INR 1 Cr in a financial year• TDS will be charged only on the amount...

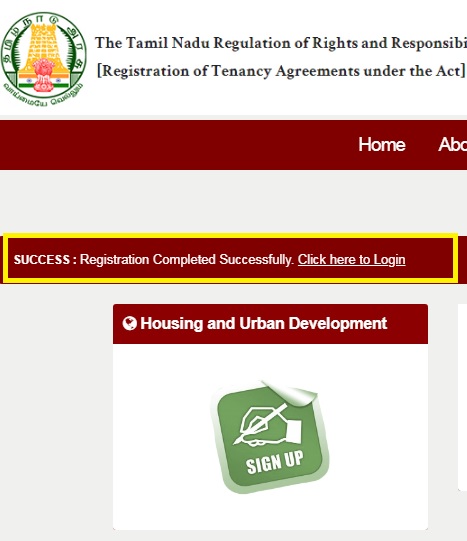

Online E-Registration of Rent Agreement Rules – Chennai

As per the official notification of rules pertaining to the Tamil Nadu Regulation of Rights and Responsibilities of Landlords and Tenants Act 2017, the government has developed a portal (www.tenancy.tn.gov.in) and will generate tenancy registration numbers for each...

Online Registration of Tenancy/Rental Agreement Rules in Tamilnadu

As per the official notification of rules pertaining to the Tamil Nadu Regulation of Rights and Responsibilities of Landlords and Tenants Act 2017, the government has developed a portal (www.tenancy.tn.gov.in) and will generate tenancy registration numbers for each...

Import Export Code Registration in Tirupur – IE Code Rs.2500

Import Export Code registration (IE Code) All businesses which are engaged in Import and Export of goods and Services from India is required for registering the Import Export Code. It is a 10 digit code which is issued by the Directorate General of Foreign Trade...

How to Register on www.tenancy.tn.gov.in – TNHUD

The TN government on February 22, 2019, introduced the new rules under the Tamil Nadu Regulation of Rights and Responsibilities of Landlords and Tenants Act, 2017, the Tamil Nadu Government has also launched an exclusive portal (www.tenancy.tn.gov.in) to create the...

How to Tie up with Swiggy in Tirupur | Partner with Swiggy

Swiggy.com has come up with New innovative methods to provide complete food ordering and delivery solution from the neighborhood restaurants to the Tirupur foodies. The delivery giant intends to reach out to the food lovers through its app-based technology.Restaurant...

Income Tax Return Filing in Tamil nadu Fy 2018-19

Income Tax Return Filing : வருமான வரி ரிட்டர்ன்ஸ் என்பது நடப்பு ஆண்டின் வருமானம் தொடர்பான வரி விவரங்களை அரசிடம் சமர்ப்பிக்கும் முறை. உங்களுடைய ஒட்டுமொத்த ஆண்டு வருமானம், குறிப்பிட்ட அளவை விட அதிகமாக இருந்தால் வருமான வரி கட்ட வேண்டும். தனிநபர்களுக்கு வருமான வரி விவரம்...

How to File Annual Return GSTR-9 for Fy 2017-18

The much-awaited GSTR - 9 i.e. Annual Return* for FY 2017-18 is now enabled for filing at the GST Portal (WWW.GST.GOV.IN) ITC figures are getting auto-populated. Also, a summary of GSTR-1 and GSTR-3B is allowed to be downloaded in PDF format. Also, “NIL” GSTR-9 RETURN...

Advisory to GST Taxpayers on Invoice Series for FY 2019-2020

Attention of all taxpayers is invited to Rule 46 (b) of the CGST Rules 2017, which specifies that the tax invoice issued by a registered person should have a consecutive serial number, not exceeding sixteen characters, in one or multiple series, containing alphabets...

Simplified GST Return Formats – Form Sahaj and Sugam, July 2018

The CBIC on Monday put up in public domain draft GST returns and formats "Sahaj and Sugam" for seeking comments from stakeholders. moreover, taxpayers who have no purchases, no output tax liability and no input tax credit to avail in any quarter of the financial year...

How to Register on e-Way Bill ewaybill.nic.in/ewaybillgst.gov.in

GST e-Way Bill Registration is Mandatory for every Supplier/transporter (registered/unregistered) who causes movement of goods of consignment value exceeding Rs.50000/-. All the registered persons under GST shall also register GST E way Bill on the portal of e-way...