How to File Form GST RFD 11 – Letter of Undertaking under GST

(a) he may supply goods or services or both Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim a refund of unutilised input tax credit; or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim a refund of such tax paid on goods or services or both supplied

Notification No. 16/2017 – Central Tax dated 7th July 2017 specifies conditions to be fulfilled for export under Letter of Undertaking (LUT) in place of a bond.

Form GST RFD 11 (LUT) is generally submitted online through GST Portal. The following exporters would need to file LUT in Form GST RFD 11. LUT shall be valid for 12 months

· Only following categories of Exporters can avail facility of LUT:

(1) Status holders, that is, Star Export houses under Foreign Trade Policy (2015-2020) OR

(2) Exporters who have received a remittance which is higher of:

(a) Rs. one crore or

(b) 10% of export turnover,

Export by Issuing Bond

Any other registered person other than mentioned above doing exports without the payment of IGST would need to file a bond which is available in the form GST RFD-11 under GST. Small exporters should file GST RFD-11 prior to the export if they want to avoid the blocking of working capital. A detailed analysis of the form GST RFD-11 is provided in our series of article on refund forms. You would need to select which type of document is furnished (Bond or LUT) in the form GST RFD-11.

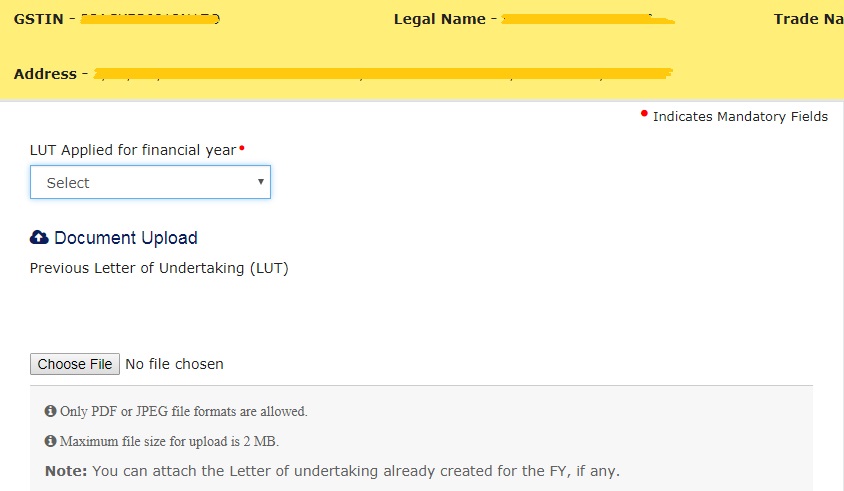

Step by Step guide to filing Form GST RFD 11

#Step 1 : After login to www.gst.gov.in Select under > Services > User Services > Furnish letter of undertaking (LUT)

GST Registration & Return filing Services in Tamilnadu

Leave your GST filing worries to our Expert

Trusted by 55,000+ Happy Businesses